Contact Us

Professional Tax & Financial Solutions

Get in Touch With Us

Get a future-focused strategy with Dynamite Tax & Financial Service, your trusted partner for smart tax preparation, business formation, and financial growth. We help you secure, grow, and optimize your financial well-being.

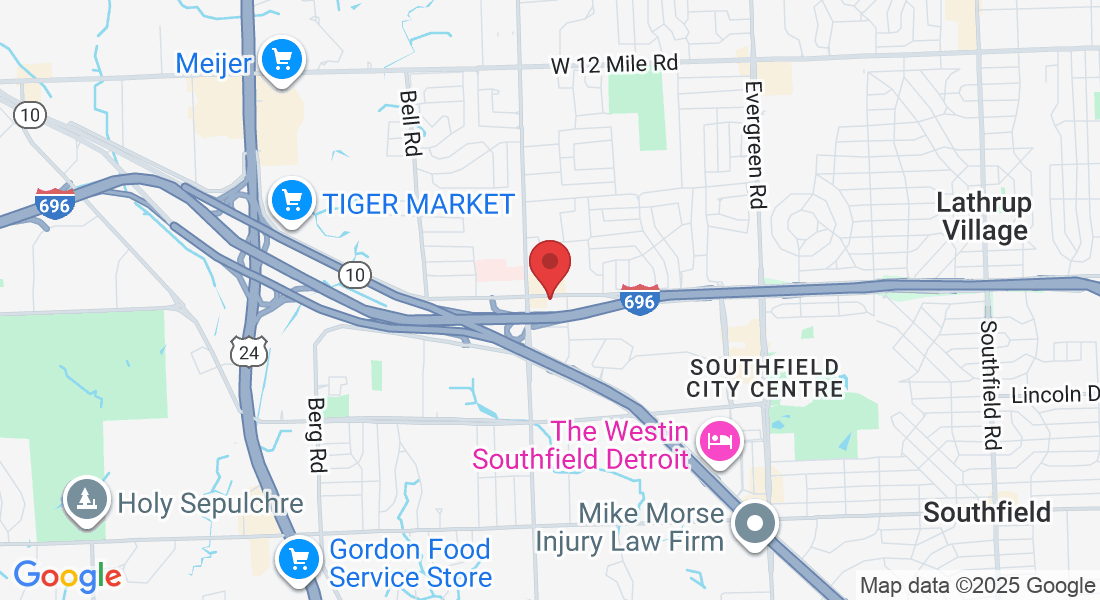

Location: 21751 W Eleven Mile Road, STE 115, Southfield, MI 48076

Get Your Free Strategy Call!

Reach out now for a personalized plan and explore tailored tax and financial solutions designed around your unique goals.

Book Your Call Today!

TESTIMONIALS

What our clients say about us

"Saved a lot"

“They helped me get an extra $2,000 that my last tax prep company was leaving on the table.”

- Jacob T.

"Takes the stress away"

"Toye is super professional and has multiple degrees including a masters in business which made me feel safe. She also gets the most which you are owed."

- Brian R.

"Trusted Team"

"I have no doubt that without Toye and Shay handling our financials we would have not seen the growth we saw last year."

- Jane M.

there’s more to offer

Money & Business Matters

Smart Tax Moves. Strategic Finance. Real Results.

How Your Personal Finances Impact Your Business Success

It’s common to think of personal and business finances as two separate areas—but in reality, they are deeply connected. The habits you build at home often influence how you make decisions within your business. When your personal finances are strong, organized, and intentional, your business gains stability, clarity, and room to grow.

A solid personal financial foundation helps you manage cash flow with confidence, make smarter investments, and avoid mixing funds. Here are a few key ways your personal money habits directly impact your business success:

1. Build a clear personal budget.

Understanding your personal expenses gives you a realistic view of what you need your business to earn. A strong budget prevents overspending and helps you avoid pulling money from your business unnecessarily.

2. Separate business and personal accounts.

This should be non-negotiable. Keeping separate accounts protects you legally, makes bookkeeping cleaner, and saves you valuable time during tax season.

3. Pay yourself consistently.

Treat yourself like a team member, not an afterthought. A consistent paycheck creates personal stability and helps keep your business cash flow predictable.

4. Maintain a personal emergency fund.

Life happens. Having a financial cushion at home ensures unexpected expenses don’t force you to dip into business funds or disrupt your operations.

5. Manage personal debt wisely.

High personal debt can limit your ability to invest in your business and increase stress. Reducing personal debt strengthens your overall financial position and opens doors for future growth.

Your business finances often mirror your personal habits. The stronger your foundation is at home, the more confident, stable, and successful you’ll be as a business owner.

If you're ready to organize your books and build a financial strategy that supports both your personal and business goals, we’re here to help.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2025. Dynamite Tax & Financial Service. All Rights Reserved.